DECISION MAKING AND RELEVANT INFORMATION

11-1

The five steps in the decision process outlined in Exhibit 11-1 of the text are:

1. Obtain information

2. Make predictions about future costs

3. Choose an alternative

4. Implement the decision

5. Evaluate performance to provide feedback

11-2

Relevant costs are expected future costs that differ among the alternative courses of action being considered. Historical costs are irrelevant because they are past costs and, therefore, cannot differ among alternative future courses of action.

11-3

No. Relevant costs are defined as those expected future costs that differ among alternative courses of action being considered. Thus, future costs that do not differ among the alternatives are irrelevant to deciding which alternative to choose.

11-4

Quantitative factors are outcomes that are measured in numerical terms. Some quantitative factors are financial––that is, they can be easily expressed in monetary terms. A direct material is an example of a quantitative financial factor.

Qualitative factors are outcomes that are difficult to measure accurately in numerical terms. An example is employee morale.

11-5

Two potential problems that should be avoided in relevant cost analysis are:

1. Do not assume all variable costs are relevant and all fixed costs are irrelevant.

2. Do not use unit-cost data directly. It can mislead decision makers because

a. it may include irrelevant costs, and

b. comparisons of unit costs computed at different output levels lead to erroneous conclusions

11-6

No. Some variable costs may not differ among the alternatives under consideration and, hence, will be irrelevant. Some fixed costs may differ among the alternatives and, hence, will be relevant.

11-7

No. Some of the total unit costs to manufacture a product may be fixed costs, and, hence, will not differ between the make and buy alternatives. These fixed costs are irrelevant to the make-or-buy decision. The key comparison is between purchase costs and the costs that will be saved if the company purchases the component parts from outside plus the additional benefits of using the resources freed up in the next best alternative use (opportunity cost).

11-8

Opportunity cost is the contribution to income that is forgone (rejected) by not using a limited resource in its next-best alternative use.

11-9

No. When deciding on the quantity of inventory to buy, managers must consider both the purchase cost per unit and the opportunity cost of funds invested in the inventory. For example, the purchase cost per unit may be low when the quantity of inventory purchased is large, but the benefit of the lower cost may be more than offset by the high opportunity cost of the funds invested in acquiring and holding inventory.

11-10

No. Managers should aim to get the highest contribution margin per unit of the constraining (that is, scarce, limiting, or critical) factor. The constraining factor is what restricts or limits the production or sale of a given product (for example, availability of machine-hours).

11-11

No. For example, if the revenues that will be lost exceed the costs that will be saved, the branch or business segment should not be shut down. Shutting down will only increase the loss. Allocated costs are always irrelevant to the shutting down decision.

11-12

Cost written off as depreciation is irrelevant when it pertains to a past cost. But the purchase cost of new equipment to be acquired in the future that will then be written off as depreciation is often relevant.

11-13

No. Managers tend to favor the alternative that makes their performance look best so they focus on the measures used in the performance-evaluation model. If the performance-evaluation model does not emphasize maximizing operating income or minimizing costs, managers will most likely not choose the alternative that maximizes operating income or minimizes costs.

11-14

The three steps in solving a linear programming problem are:

1. Determine the objective function.

2. Specify the constraints.

3. Compute the optimal solution.

11-15

The text outlines two methods of determining the optimal solution to an LP problem:

1. Trial-and-error solution approach

2. Graphical solution approach

Most LP applications in practice use standard software packages that rely on the simplex method to compute the optimal solution.

11-16 Disposal of assets.

1.

This is an unfortunate situation, yet the $80,000 costs are irrelevant regarding the decision to remachine or scrap. The only relevant factors are the future revenues and future costs. By ignoring the accumulated costs and deciding on the basis of expected future costs, operating income will be maximized (or losses minimized). The difference in favor of remachining is $3,000:

2.

This, too, is an unfortunate situation. But the $100,000 original cost is irrelevant to this decision. The difference in relevant costs in favor of rebuilding is $7,000 as follows:

.JPG)

Note, here, that the current disposal price of $10,000 is relevant, but the original cost (or book value, if the truck were not brand new) is irrelevant.

11-17 The careening personal computer.

Considered alone, book value is irrelevant as a measure of loss when equipment is destroyed. The measure of the loss is replacement cost or some computation of the present value of future services lost because of equipment loss or damage. In the specific case described, the following observations may be apt:

1.

A fully depreciated item probably is relatively old. Chances are that the loss from this equipment is less than the loss for a partially depreciated item because the replacement cost of an old item would be far less than that for a nearly new item.

2.

The loss of an old item, assuming replacement is necessary, automatically accelerates the timing of replacement. Thus, if the old item were to be junked and replaced tomorrow, no economic loss would be evident. However, if the old item were supposed to last five more years, replacement is accelerated five years. The best practical measure of such a loss probably would be the cost of comparable used equipment that had five years of remaining useful life.

The fact that the computer was fully depreciated also means the accounting reports will not be affected by the accident. If accounting reports are used to evaluate the office manager's performance, the manager will prefer any accidents to be on fully depreciated units.

11-18 Multiple choice.

1. (b)

Effect on operating income = $1.50 x 20,000 units

.......................................= $30,000 increase

2. (b)

.JPG)

11-19 Special order, activity-based costing (CMA, adapted).

1.

Award Plus's operating income under the alternatives of accepting/rejecting the special order are:

1 ($262,500 ÷ 7,500) x 10,000

2 ($300,000 ÷ 7,500) x 10,000

3 $75,000 + (25 x $500)

Alternatively, we could calculate the incremental revenue and the incremental costs of the additional 2,500 units as follows:

.JPG)

Award Plus should accept the one-time-only special order if it has no long-term implications because accepting the order increases Award Plus's operating income by $50,000.

If, however, accepting the special order would cause the regular customers to be dissatisfied or to demand lower prices, then Award Plus will have to trade off the $50,000 gain from accepting the special order against the operating income it might lose from regular customers.

2.

Award Plus has a capacity of 9,000 medals. Therefore, if it accepts the special one-time order of 2,500 medals, it can sell only 6,500 medals instead of the 7,500 medals that it currently sells to existing customers. That is, by accepting the special order, Award Plus must forgo sales of 1,000 medals to its regular customers. Alternatively, Award Plus can reject the special order and continue to sell 7,500 medals to its regular customers.

Award Plus's operating income from selling 6,500 medals to regular customers and 2,500 medals under one-time special order follow:

.JPG)

1$35 = $262,500 ÷ 7,500

2$40 = $300,000 ÷ 7,500

3Award Plus makes regular medals in batch sizes of 50. To produce 6,500 medals requires 130 (6,500 ÷ 50) batches.

Accepting the special order will result in a decrease in operating income of $15,000 ($37,500 – $22,500). The special order should, therefore, be rejected.

A more direct approach would be to focus on the incremental effects––the benefits of accepting the special order of 2,500 units versus the costs of selling 1,000 fewer units to regular customers. Increase in operating income from the 2,500-unit special order equals $50,000 (requirement 1). The loss in operating income from selling 1,000 fewer units to regular customers equals:

.JPG)

Accepting the special order will result in a decrease in operating income of $15,000 ($50,000 – $65,000). The special order should, therefore, be rejected.

3.

Award Plus should not accept the special order.

.JPG)

The special order should, therefore, be rejected.

11-20 Inventory decision, opportunity costs.

1.

Unit cost, orders of 20,000 ............................$8.00

Unit cost, order of 240,000 (0.95 x $8.00) ......$7.60

Alternatives under consideration:

(a) Buy 240,000 units at start of year.

(b) Buy 20,000 units at start of each month.

Average investment in inventory:

Opportunity cost of interest forgone from 240,000-unit purchase at start of year

= $832,000 x 0.08 = $66,560

2.

No. The $66,560 is an opportunity cost rather than an incremental or outlay cost. No actual transaction records the $66,560 as an entry in the accounting system.

3.

The following table presents the two alternatives:

.JPG)

Column (3) indicates that purchasing 240,000 spark plugs at the beginning of the year is preferred relative to purchasing 20,000 spark plugs at the beginning of each month because the lower purchase cost exceeds the opportunity cost of holding larger inventory. If other incremental benefits of holding lower inventory such as lower insurance, materials handling, storage, obsolescence, and breakage costs were considered, the costs under Alternative A would have been higher, and Alternative B may have been preferred.

11-21 Relevant costs, contribution margin, product emphasis.

1.

2.

The argument fails to recognize that shelf space is the constraining factor. There are only 12 feet of front shelf space to be devoted to drinks. Sexton should aim to get the highest daily contribution margin per foot of front shelf space:

.JPG)

3.

The allocation that maximizes the daily contribution from soft drink sales is:

.JPG)

The maximum of six feet of front shelf space will be devoted to Cola because it has the highest contribution margin per unit of the constraining factor. Four feet of front shelf space will be devoted to Lemonade, which has the second highest contribution margin per unit of the constraining factor. No more shelf space can be devoted to Lemonade since each of the remaining two products; Natural Orange Juice and Punch (that have the second lowest and lowest contribution margins per unit of the constraining factor) must each be given at least one foot of front shelf space.

11-22 Selection of most profitable product.

Only Model 14 should be produced. The key to this problem is the relationship of manufacturing overhead to each product. Note that it takes twice as long to produce Model 9; machine-hours for Model 9 are twice that for Model 14. Management should choose the product mix that maximizes operating income for a given production capacity (the scarce resource in this situation). In this case, Model 14 will yield a $9.50 contribution to fixed costs per machine hour, and Model 9 will yield $9.00:

11-23 Which base to close, relevant-cost analysis, opportunity costs.

The future outlay operating costs will be $400 million regardless of which base is closed, given the additional $100 million in costs at Everett if Alameda is closed. Further, one of the bases will permanently remain open while the other will be shut down. The only relevant revenue and cost comparisons are:

a. $500 million from sale of the Alameda base. Note that the historical cost of building the Alameda base ($100 million) is irrelevant. Note, also, that a future increase in the value of the land at the Alameda base is also irrelevant. One of the bases must be kept open, so if it is decided to keep the Alameda base open, the Defense Department will not be able to sell this land at a future date.

b. $60 million in savings in fixed income note if the Everett base is closed. Again, the historical cost of building the Everett base ($150 million) is irrelevant.

The relevant costs and benefits analysis favors closing the Alameda base despite the objections raised by the California delegation in Congress. The net benefit equals $440 ($500 – $60) million.

11-24 Closing and opening stores.

1.

Solution Exhibit 11-24, Column 1, presents the relevant loss in revenues and the relevant savings in costs from closing the Rhode Island store. Lopez is correct that Sanchez Corporation’s operating income would increase by $7,000 if it closes down the Rhode Island store. Closing down the Rhode Island store results in a loss of revenues of $860,000 but cost savings of $867,000 (from cost of goods sold, rent, labor, utilities, and corporate costs). Note that by closing down the Rhode Island store, Sanchez Corporation will save none of the equipment-related costs because this is a past cost. Also note that the relevant corporate overhead costs are the actual corporate overhead costs $44,000 that Sanchez expects to save by closing the Rhode Island store. The corporate overhead of $40,000 allocated to the Rhode Island store is irrelevant to the analysis.

2.

Solution Exhibit 11-24, Column 2, presents the relevant revenues and relevant costs of opening another store like the Rhode Island store. Lopez is correct that opening such a store would increase Sanchez Corporation’s operating income by $11,000. Incremental revenues of $860,000 exceed the incremental costs of $849,000 (from higher cost of goods sold, rent, labor, utilities, and some additional corporate costs). Note that the cost of equipment written off as depreciation is relevant because it is an expected future cost that Sanchez will incur only if it opens the new store. Also note that the relevant corporate overhead costs are the $4,000 of actual corporate overhead costs that Sanchez expects to incur as a result of opening the new store. Sanchez may, in fact, allocate more than $4,000 of corporate overhead to the new store but this allocation is irrelevant to the analysis.

The key reason that Sanchez’s operating income increases either if it closes down the Rhode Island store or if it opens another store like it is the behavior of corporate overhead costs. By closing down the Rhode Island store, Sanchez can significantly reduce corporate overhead costs presumably by reducing the corporate staff that oversees the Rhode Island operation. On the other hand, adding another store like Rhode Island does not increase actual corporate costs by much, presumably because the existing corporate staff will be able to oversee the new store as well.

11-25 Choosing customers.

If Broadway accepts the additional business from Kelly, it would take an additional 500 machine-hours. If Broadway accepts all of Kelly’s and Taylor’s business for February, it would require 2,500 machine-hours (1,500 hours for Taylor and 1,000 hours for Kelly). Broadway has only 2,000 hours of machine capacity. It must, therefore, choose how much of the Taylor or Kelly business to accept.

To maximize operating income, Broadway should maximize contribution margin per unit of the constrained resource. (Fixed costs will remain unchanged at $100,000 regardless of the business Broadway chooses to accept in February, and is, therefore, irrelevant.) The contribution margin per unit of the constrained resource for each customer in January is:

Since the $80,000 of additional Kelly business in February is identical to jobs done in January, it will also have a contribution margin of $64 per machine-hour, which is greater than the contribution margin of $52 per machine-hour from Taylor. To maximize operating income, Broadway should first allocate all the capacity needed to take the Kelly Corporation business (1,000 machine-hours) and then allocate the remaining 1,000 (2,000 – 1,000) machine-hours to Taylor.

.JPG)

11-26 Relevance of equipment costs.

1a. Statements of Cash Receipts and Disbursements

*Some students ignore this item because it is the same for each alternative. However, note that a statement for the entire year has been requested. Obviously, the $20,000 would affect Year 1 only under both the "keep" and "buy" alternatives.

The difference is $8,000 for four years taken together. In particular, note that the $20,000 book value can be omitted from the comparison. Merely cross out the entire line; although the column totals are affected, the net difference is still $8,000.

1b. Again, the difference is $8,000:

.JPG)

*As in part (1), the $20,000 book value may be omitted from the comparison without changing the $8,000 difference. This adjustment would mean excluding the depreciation item of $5,000 per year (a cumulative effect of $20,000) under the "keep" alternative and excluding the book value item of $20,000 in the loss on disposal computation under the "buy" alternative.

1c. The $20,000 purchase cost of the old equipment, the revenues, and the other costs are irrelevant because their amounts are common to both alternatives.

2.

The net difference would be unaffected. Any number may be substituted for the original $20,000 figure without changing the final answer. Of course, the net cash outflows under both alternatives would be high. The Auto Wash manager really blundered. However, keeping the old equipment will increase the cost of the blunder to the cumulative tune of $8,000 over the next four years.

3.

Book value is irrelevant in decisions about the replacement of equipment, because it is a past (historical) cost. All past costs are down the drain. Nothing can change what has already been spent or what has already happened. The $20,000 has been spent. How it is subsequently accounted for is irrelevant. The analysis in requirement (1) clearly shows that we may completely ignore the $20,000 and still have a correct analysis. The only relevant items are those expected future items that will differ among alternatives.

Despite the economic analysis shown here, many managers would keep the old machine rather than replace it. Why? Because, in many organizations, the income statements of part (2) would be a principal means of evaluating performance. Note that the first-year operating income would be higher under the "keep" alternative. The conventional accrual accounting model might motivate managers toward maximizing their first-year reported operating income at the expense of long-run cumulative betterment for the organization as a whole. This criticism is often made of the accrual accounting model. That is, the action favored by the "correct" or "best" economic decision model may not be taken because the performance-evaluation model is either inconsistent with the decision model or because the focus is on only the short-run part of the performance-evaluation model.

There is yet another potential conflict between the decision model and the performance evaluation model. Replacing the machine so soon after it is purchased may reflect badly on the manager’s capabilities and performance. Why didn’t the manager search and find the new machine before buying the old machine? Replacing the old machine one day later at a loss may make the manager appear incompetent to his or her superiors. If the manager’s bosses have no knowledge of the better machine, the manager may prefer to keep the existing machine rather than alert his or her bosses about the better machine.

11-28 Contribution approach, relevant costs.

1.

2.

.JPG)

All other costs are irrelevant.

On the basis of quantitative factors alone, Air Frisco should decrease its fare to $480 because reducing the fare gives Air Frisco a higher contribution margin from passengers ($89,379.20 versus $88,000).

3.

In evaluating whether Air Frisco should charter its plane to Travel International, we compare the charter alternative to the solution in requirement 2 because requirement 2 is preferred to requirement 1.

.JPG)

Air Frisco gets $74,500 per flight from chartering the plane to Travel International. On the basis of quantitative financial factors, Air Frisco is better off not chartering the plane and, instead, lowering its own fares.

Other qualitative factors that Air Frisco should consider in coming to a decision are:

a. The lower risk from chartering its plane relative to the uncertainties regarding the number of passengers it might get on its scheduled flights.

b. The stability of the relationship between Air Frisco and Travel International. If this is not a long-term arrangement, Air Frisco may lose current market share and not benefit from sustained charter revenues.

11-29 Relevant costs, opportunity costs.

1.

Easyspread 2.0 has a higher relevant operating income than Easyspread 1.0. Based on this analysis, Easyspread 2.0 should be introduced immediately:

................................................Easyspread 1.0 ...Easyspread 2.0

Relevant revenues ....................................$150 .....................$185

Relevant costs:

...Manuals, diskettes, compact discs ..$ 0 .........................$25

.......Total relevant costs .............................__0 ......................_25

Relevant operating income ........................$150 .....................$160

Reasons for other cost items being irrelevant are:

Easyspread 1.0

· Manuals, diskettes—already incurred

· Development costs—already incurred

· Marketing and administrative—fixed costs of period

Easyspread 2.0

· Development costs—already incurred

· Marketing and administration—fixed costs of period

Note that total marketing and administration costs will not change whether Easyspread 2.0 is introduced on July 1, 2006, or on October 1, 2006.

2.

Other factors to be considered:

a. Customer satisfaction. If 2.0 is significantly better than 1.0 for its customers, a customer

driven organization would immediately introduce it unless other factors offset this bias towards “do what is best for the customer.”

b. Quality level of Easyspread 2.0. It is critical for new software products to be fully debugged. Easyspread 2.0 must be error-free. Consider an immediate release only if 2.0 passes all quality tests and can be fully supported by the salesforce.

c. Importance of being perceived to be a market leader. Being first in the market with a new product can give Basil Software a “first-mover advantage,” e.g., capturing an initial large share of the market that, in itself, causes future potential customers to lean towards purchasing Easyspread 2.0. Moreover, by introducing 2.0 earlier, Basil can get quick feedback from users about ways to further refine the software while its competitors are still working on their own first versions. Moreover, by locking in early customers, Basil may increase the likelihood of these customers also buying future upgrades of Easyspread 2.0.

d. Morale of developers. These are key people at Basil Software. Delaying introduction of a new product can hurt their morale, especially if a competitor then preempts Basil from being viewed as a market leader.

11-30 Product mix, relevant costs (N. Melumad, adapted).

1.

....................................................................R3 ................HP6

Selling price ...............................................$100 ................$150

Variable manufacturing cost per unit ................60 ..................100

Variable marketing cost per unit ...................._15 .................._35

Total variable costs per unit .........................._75 ..................135

Contribution margin per unit ........................$ 25 .................$ 15

Contribution margin per hour of the

...constrained resource (the regular machine) $25 ÷ 1 ........$15 ÷ 0.5

.................................................................= $25...............= $30

Total contribution margin from selling

.....only R3 or only HP6

R3: $25 x 50,000; HP6: $30 x 50,000 .........$1,250,000 .....$1,500,000

Less Lease costs of high-precision machine

.....to produce and sell HP6 ........................_____-___........__300,000

Net relevant benefit ..................................$1,250,000 ......$1,200,000

Even though HP6 has the higher contribution margin per unit of the constrained resource, the fact that Pendleton must incur additional costs of $300,000 to achieve this higher contribution margin means that Pendleton is better off using its entire 50,000-hour capacity on the regular machine to produce and sell 50,000 units (50,000 hours ÷ 1 hour per unit) of R3. The additional contribution from selling HP6 rather than R3 is $250,000 ($1,500,000 - $1,250,000), which is not enough to cover the additional costs of leasing the high-precision machine. Note that, because all other overhead costs are fixed and cannot be changed, they are irrelevant for the decision.

2.

If capacity of the regular machines is increased by 15,000 machine-hours to 65,000 machine-hours (50,000 originally + 15,000 new), the net relevant benefit from producing R3 and HP6 is as follows:

.........................................................................R3 ................HP6

Total contribution margin from selling only

.....R3 or only HP6

R3: $25 x 65,000; HP6: $30 x 65,000 ............$1,625,000 ....$1,950,000

Less Lease costs of high-precision machine

.....that would be incurred if HP6 is

.....produced and sold ..........................................-.................300,000

Less Cost of increasing capacity by

.....15,000 hours on regular machine .............__150,000 .......__150,000

Net relevant benefit .....................................$1,475,000 ......$1,500,000

Investing in the additional capacity increases Pendleton’s operating income by $250,000 ($1,500,000 calculated in requirement 2 minus $1,250,000 calculated in requirement 1), so Pendleton should add 15,000 hours to the regular machine. With the extra capacity available to it, Pendleton should use its entire capacity to produce HP6. Using all 65,000 hours of capacity to produce HP6 rather than to produce R3 generates additional contribution margin of $325,000 ($1,950,000 - $1,625,000) which is more than the additional cost of $300,000 to lease the high-precision machine. Pendleton should therefore produce and sell 130,000 units of HP6 (65,000 hours ÷ 0.5 hours per unit of HP6) and zero units of R3.

3.

The first step is to compare the operating profits that Pendleton could earn if it accepted the Carter Corporation offer for 20,000 units with the operating profits Pendleton is currently earning. S3 has the highest contribution margin per hour on the regular machine and requires no additional investment such as leasing a high-precision machine. To produce the 20,000 units of S3 requested by Carter Corporation, Pendleton would require 20,000 hours on the regular machine resulting in contribution margin of $35 x 20,000 = $700,000.

Pendleton now has 45,000 hours available on the regular machine to produce R3 or HP6.

........................................ ..............................R3 ...............HP6

Total contribution margin from selling

.....only R3 or only HP6

.....R3: $25 x 45,000; HP6: $30 x 45,000 .........$1,125,000 ....$1,350,000

Less Lease costs of high-precision machine

.....to produce and sell HP 6 ............................____-____ ....___300,000

Net relevant benefit .......................................$1,125,000 .....$1,050,000

Pendleton should use all the 45,000 hours of available capacity to produce 45,000 units of R3. Thus, the product mix that maximizes operating income is 20,000 units of S3, 45,000 units of R3, and zero units of HP6. This optimal mix results in a contribution margin of $1,825,000 ($700,000 from S3 and $1,125,000 from R3). Relative to requirement 2, operating income increases by $325,000 ($1,825,000 minus $1,500,000 calculated in requirement 2). Hence, Pendleton should accept the Carter Corporation business and supply 20,000 units of S3.

11-31 Dropping a product line, selling more units.

1.

The incremental revenue losses and incremental savings in cost by discontinuing the Tables product line follows:

Dropping the Tables product line results in revenue losses of $500,000 and cost savings of $370,000. Hence, Grossman Corporation’s operating income will be $130,000 higher if it does not drop the Tables line.

11-1

The five steps in the decision process outlined in Exhibit 11-1 of the text are:

1. Obtain information

2. Make predictions about future costs

3. Choose an alternative

4. Implement the decision

5. Evaluate performance to provide feedback

11-2

Relevant costs are expected future costs that differ among the alternative courses of action being considered. Historical costs are irrelevant because they are past costs and, therefore, cannot differ among alternative future courses of action.

11-3

No. Relevant costs are defined as those expected future costs that differ among alternative courses of action being considered. Thus, future costs that do not differ among the alternatives are irrelevant to deciding which alternative to choose.

11-4

Quantitative factors are outcomes that are measured in numerical terms. Some quantitative factors are financial––that is, they can be easily expressed in monetary terms. A direct material is an example of a quantitative financial factor.

Qualitative factors are outcomes that are difficult to measure accurately in numerical terms. An example is employee morale.

11-5

Two potential problems that should be avoided in relevant cost analysis are:

1. Do not assume all variable costs are relevant and all fixed costs are irrelevant.

2. Do not use unit-cost data directly. It can mislead decision makers because

a. it may include irrelevant costs, and

b. comparisons of unit costs computed at different output levels lead to erroneous conclusions

11-6

No. Some variable costs may not differ among the alternatives under consideration and, hence, will be irrelevant. Some fixed costs may differ among the alternatives and, hence, will be relevant.

11-7

No. Some of the total unit costs to manufacture a product may be fixed costs, and, hence, will not differ between the make and buy alternatives. These fixed costs are irrelevant to the make-or-buy decision. The key comparison is between purchase costs and the costs that will be saved if the company purchases the component parts from outside plus the additional benefits of using the resources freed up in the next best alternative use (opportunity cost).

11-8

Opportunity cost is the contribution to income that is forgone (rejected) by not using a limited resource in its next-best alternative use.

11-9

No. When deciding on the quantity of inventory to buy, managers must consider both the purchase cost per unit and the opportunity cost of funds invested in the inventory. For example, the purchase cost per unit may be low when the quantity of inventory purchased is large, but the benefit of the lower cost may be more than offset by the high opportunity cost of the funds invested in acquiring and holding inventory.

11-10

No. Managers should aim to get the highest contribution margin per unit of the constraining (that is, scarce, limiting, or critical) factor. The constraining factor is what restricts or limits the production or sale of a given product (for example, availability of machine-hours).

11-11

No. For example, if the revenues that will be lost exceed the costs that will be saved, the branch or business segment should not be shut down. Shutting down will only increase the loss. Allocated costs are always irrelevant to the shutting down decision.

11-12

Cost written off as depreciation is irrelevant when it pertains to a past cost. But the purchase cost of new equipment to be acquired in the future that will then be written off as depreciation is often relevant.

11-13

No. Managers tend to favor the alternative that makes their performance look best so they focus on the measures used in the performance-evaluation model. If the performance-evaluation model does not emphasize maximizing operating income or minimizing costs, managers will most likely not choose the alternative that maximizes operating income or minimizes costs.

11-14

The three steps in solving a linear programming problem are:

1. Determine the objective function.

2. Specify the constraints.

3. Compute the optimal solution.

11-15

The text outlines two methods of determining the optimal solution to an LP problem:

1. Trial-and-error solution approach

2. Graphical solution approach

Most LP applications in practice use standard software packages that rely on the simplex method to compute the optimal solution.

11-16 Disposal of assets.

1.

This is an unfortunate situation, yet the $80,000 costs are irrelevant regarding the decision to remachine or scrap. The only relevant factors are the future revenues and future costs. By ignoring the accumulated costs and deciding on the basis of expected future costs, operating income will be maximized (or losses minimized). The difference in favor of remachining is $3,000:

2.

This, too, is an unfortunate situation. But the $100,000 original cost is irrelevant to this decision. The difference in relevant costs in favor of rebuilding is $7,000 as follows:

.JPG)

Note, here, that the current disposal price of $10,000 is relevant, but the original cost (or book value, if the truck were not brand new) is irrelevant.

11-17 The careening personal computer.

Considered alone, book value is irrelevant as a measure of loss when equipment is destroyed. The measure of the loss is replacement cost or some computation of the present value of future services lost because of equipment loss or damage. In the specific case described, the following observations may be apt:

1.

A fully depreciated item probably is relatively old. Chances are that the loss from this equipment is less than the loss for a partially depreciated item because the replacement cost of an old item would be far less than that for a nearly new item.

2.

The loss of an old item, assuming replacement is necessary, automatically accelerates the timing of replacement. Thus, if the old item were to be junked and replaced tomorrow, no economic loss would be evident. However, if the old item were supposed to last five more years, replacement is accelerated five years. The best practical measure of such a loss probably would be the cost of comparable used equipment that had five years of remaining useful life.

The fact that the computer was fully depreciated also means the accounting reports will not be affected by the accident. If accounting reports are used to evaluate the office manager's performance, the manager will prefer any accidents to be on fully depreciated units.

11-18 Multiple choice.

1. (b)

Effect on operating income = $1.50 x 20,000 units

.......................................= $30,000 increase

2. (b)

.JPG)

11-19 Special order, activity-based costing (CMA, adapted).

1.

Award Plus's operating income under the alternatives of accepting/rejecting the special order are:

1 ($262,500 ÷ 7,500) x 10,000

2 ($300,000 ÷ 7,500) x 10,000

3 $75,000 + (25 x $500)

Alternatively, we could calculate the incremental revenue and the incremental costs of the additional 2,500 units as follows:

.JPG)

Award Plus should accept the one-time-only special order if it has no long-term implications because accepting the order increases Award Plus's operating income by $50,000.

If, however, accepting the special order would cause the regular customers to be dissatisfied or to demand lower prices, then Award Plus will have to trade off the $50,000 gain from accepting the special order against the operating income it might lose from regular customers.

2.

Award Plus has a capacity of 9,000 medals. Therefore, if it accepts the special one-time order of 2,500 medals, it can sell only 6,500 medals instead of the 7,500 medals that it currently sells to existing customers. That is, by accepting the special order, Award Plus must forgo sales of 1,000 medals to its regular customers. Alternatively, Award Plus can reject the special order and continue to sell 7,500 medals to its regular customers.

Award Plus's operating income from selling 6,500 medals to regular customers and 2,500 medals under one-time special order follow:

.JPG)

1$35 = $262,500 ÷ 7,500

2$40 = $300,000 ÷ 7,500

3Award Plus makes regular medals in batch sizes of 50. To produce 6,500 medals requires 130 (6,500 ÷ 50) batches.

Accepting the special order will result in a decrease in operating income of $15,000 ($37,500 – $22,500). The special order should, therefore, be rejected.

A more direct approach would be to focus on the incremental effects––the benefits of accepting the special order of 2,500 units versus the costs of selling 1,000 fewer units to regular customers. Increase in operating income from the 2,500-unit special order equals $50,000 (requirement 1). The loss in operating income from selling 1,000 fewer units to regular customers equals:

.JPG)

Accepting the special order will result in a decrease in operating income of $15,000 ($50,000 – $65,000). The special order should, therefore, be rejected.

3.

Award Plus should not accept the special order.

.JPG)

The special order should, therefore, be rejected.

11-20 Inventory decision, opportunity costs.

1.

Unit cost, orders of 20,000 ............................$8.00

Unit cost, order of 240,000 (0.95 x $8.00) ......$7.60

Alternatives under consideration:

(a) Buy 240,000 units at start of year.

(b) Buy 20,000 units at start of each month.

Average investment in inventory:

Opportunity cost of interest forgone from 240,000-unit purchase at start of year

= $832,000 x 0.08 = $66,560

2.

No. The $66,560 is an opportunity cost rather than an incremental or outlay cost. No actual transaction records the $66,560 as an entry in the accounting system.

3.

The following table presents the two alternatives:

.JPG)

Column (3) indicates that purchasing 240,000 spark plugs at the beginning of the year is preferred relative to purchasing 20,000 spark plugs at the beginning of each month because the lower purchase cost exceeds the opportunity cost of holding larger inventory. If other incremental benefits of holding lower inventory such as lower insurance, materials handling, storage, obsolescence, and breakage costs were considered, the costs under Alternative A would have been higher, and Alternative B may have been preferred.

11-21 Relevant costs, contribution margin, product emphasis.

1.

2.

The argument fails to recognize that shelf space is the constraining factor. There are only 12 feet of front shelf space to be devoted to drinks. Sexton should aim to get the highest daily contribution margin per foot of front shelf space:

.JPG)

3.

The allocation that maximizes the daily contribution from soft drink sales is:

.JPG)

The maximum of six feet of front shelf space will be devoted to Cola because it has the highest contribution margin per unit of the constraining factor. Four feet of front shelf space will be devoted to Lemonade, which has the second highest contribution margin per unit of the constraining factor. No more shelf space can be devoted to Lemonade since each of the remaining two products; Natural Orange Juice and Punch (that have the second lowest and lowest contribution margins per unit of the constraining factor) must each be given at least one foot of front shelf space.

11-22 Selection of most profitable product.

Only Model 14 should be produced. The key to this problem is the relationship of manufacturing overhead to each product. Note that it takes twice as long to produce Model 9; machine-hours for Model 9 are twice that for Model 14. Management should choose the product mix that maximizes operating income for a given production capacity (the scarce resource in this situation). In this case, Model 14 will yield a $9.50 contribution to fixed costs per machine hour, and Model 9 will yield $9.00:

11-23 Which base to close, relevant-cost analysis, opportunity costs.

The future outlay operating costs will be $400 million regardless of which base is closed, given the additional $100 million in costs at Everett if Alameda is closed. Further, one of the bases will permanently remain open while the other will be shut down. The only relevant revenue and cost comparisons are:

a. $500 million from sale of the Alameda base. Note that the historical cost of building the Alameda base ($100 million) is irrelevant. Note, also, that a future increase in the value of the land at the Alameda base is also irrelevant. One of the bases must be kept open, so if it is decided to keep the Alameda base open, the Defense Department will not be able to sell this land at a future date.

b. $60 million in savings in fixed income note if the Everett base is closed. Again, the historical cost of building the Everett base ($150 million) is irrelevant.

The relevant costs and benefits analysis favors closing the Alameda base despite the objections raised by the California delegation in Congress. The net benefit equals $440 ($500 – $60) million.

11-24 Closing and opening stores.

1.

Solution Exhibit 11-24, Column 1, presents the relevant loss in revenues and the relevant savings in costs from closing the Rhode Island store. Lopez is correct that Sanchez Corporation’s operating income would increase by $7,000 if it closes down the Rhode Island store. Closing down the Rhode Island store results in a loss of revenues of $860,000 but cost savings of $867,000 (from cost of goods sold, rent, labor, utilities, and corporate costs). Note that by closing down the Rhode Island store, Sanchez Corporation will save none of the equipment-related costs because this is a past cost. Also note that the relevant corporate overhead costs are the actual corporate overhead costs $44,000 that Sanchez expects to save by closing the Rhode Island store. The corporate overhead of $40,000 allocated to the Rhode Island store is irrelevant to the analysis.

2.

Solution Exhibit 11-24, Column 2, presents the relevant revenues and relevant costs of opening another store like the Rhode Island store. Lopez is correct that opening such a store would increase Sanchez Corporation’s operating income by $11,000. Incremental revenues of $860,000 exceed the incremental costs of $849,000 (from higher cost of goods sold, rent, labor, utilities, and some additional corporate costs). Note that the cost of equipment written off as depreciation is relevant because it is an expected future cost that Sanchez will incur only if it opens the new store. Also note that the relevant corporate overhead costs are the $4,000 of actual corporate overhead costs that Sanchez expects to incur as a result of opening the new store. Sanchez may, in fact, allocate more than $4,000 of corporate overhead to the new store but this allocation is irrelevant to the analysis.

The key reason that Sanchez’s operating income increases either if it closes down the Rhode Island store or if it opens another store like it is the behavior of corporate overhead costs. By closing down the Rhode Island store, Sanchez can significantly reduce corporate overhead costs presumably by reducing the corporate staff that oversees the Rhode Island operation. On the other hand, adding another store like Rhode Island does not increase actual corporate costs by much, presumably because the existing corporate staff will be able to oversee the new store as well.

11-25 Choosing customers.

If Broadway accepts the additional business from Kelly, it would take an additional 500 machine-hours. If Broadway accepts all of Kelly’s and Taylor’s business for February, it would require 2,500 machine-hours (1,500 hours for Taylor and 1,000 hours for Kelly). Broadway has only 2,000 hours of machine capacity. It must, therefore, choose how much of the Taylor or Kelly business to accept.

To maximize operating income, Broadway should maximize contribution margin per unit of the constrained resource. (Fixed costs will remain unchanged at $100,000 regardless of the business Broadway chooses to accept in February, and is, therefore, irrelevant.) The contribution margin per unit of the constrained resource for each customer in January is:

Since the $80,000 of additional Kelly business in February is identical to jobs done in January, it will also have a contribution margin of $64 per machine-hour, which is greater than the contribution margin of $52 per machine-hour from Taylor. To maximize operating income, Broadway should first allocate all the capacity needed to take the Kelly Corporation business (1,000 machine-hours) and then allocate the remaining 1,000 (2,000 – 1,000) machine-hours to Taylor.

.JPG)

11-26 Relevance of equipment costs.

1a. Statements of Cash Receipts and Disbursements

*Some students ignore this item because it is the same for each alternative. However, note that a statement for the entire year has been requested. Obviously, the $20,000 would affect Year 1 only under both the "keep" and "buy" alternatives.

The difference is $8,000 for four years taken together. In particular, note that the $20,000 book value can be omitted from the comparison. Merely cross out the entire line; although the column totals are affected, the net difference is still $8,000.

1b. Again, the difference is $8,000:

.JPG)

*As in part (1), the $20,000 book value may be omitted from the comparison without changing the $8,000 difference. This adjustment would mean excluding the depreciation item of $5,000 per year (a cumulative effect of $20,000) under the "keep" alternative and excluding the book value item of $20,000 in the loss on disposal computation under the "buy" alternative.

1c. The $20,000 purchase cost of the old equipment, the revenues, and the other costs are irrelevant because their amounts are common to both alternatives.

2.

The net difference would be unaffected. Any number may be substituted for the original $20,000 figure without changing the final answer. Of course, the net cash outflows under both alternatives would be high. The Auto Wash manager really blundered. However, keeping the old equipment will increase the cost of the blunder to the cumulative tune of $8,000 over the next four years.

3.

Book value is irrelevant in decisions about the replacement of equipment, because it is a past (historical) cost. All past costs are down the drain. Nothing can change what has already been spent or what has already happened. The $20,000 has been spent. How it is subsequently accounted for is irrelevant. The analysis in requirement (1) clearly shows that we may completely ignore the $20,000 and still have a correct analysis. The only relevant items are those expected future items that will differ among alternatives.

Despite the economic analysis shown here, many managers would keep the old machine rather than replace it. Why? Because, in many organizations, the income statements of part (2) would be a principal means of evaluating performance. Note that the first-year operating income would be higher under the "keep" alternative. The conventional accrual accounting model might motivate managers toward maximizing their first-year reported operating income at the expense of long-run cumulative betterment for the organization as a whole. This criticism is often made of the accrual accounting model. That is, the action favored by the "correct" or "best" economic decision model may not be taken because the performance-evaluation model is either inconsistent with the decision model or because the focus is on only the short-run part of the performance-evaluation model.

There is yet another potential conflict between the decision model and the performance evaluation model. Replacing the machine so soon after it is purchased may reflect badly on the manager’s capabilities and performance. Why didn’t the manager search and find the new machine before buying the old machine? Replacing the old machine one day later at a loss may make the manager appear incompetent to his or her superiors. If the manager’s bosses have no knowledge of the better machine, the manager may prefer to keep the existing machine rather than alert his or her bosses about the better machine.

11-28 Contribution approach, relevant costs.

1.

2.

.JPG)

All other costs are irrelevant.

On the basis of quantitative factors alone, Air Frisco should decrease its fare to $480 because reducing the fare gives Air Frisco a higher contribution margin from passengers ($89,379.20 versus $88,000).

3.

In evaluating whether Air Frisco should charter its plane to Travel International, we compare the charter alternative to the solution in requirement 2 because requirement 2 is preferred to requirement 1.

.JPG)

Air Frisco gets $74,500 per flight from chartering the plane to Travel International. On the basis of quantitative financial factors, Air Frisco is better off not chartering the plane and, instead, lowering its own fares.

Other qualitative factors that Air Frisco should consider in coming to a decision are:

a. The lower risk from chartering its plane relative to the uncertainties regarding the number of passengers it might get on its scheduled flights.

b. The stability of the relationship between Air Frisco and Travel International. If this is not a long-term arrangement, Air Frisco may lose current market share and not benefit from sustained charter revenues.

11-29 Relevant costs, opportunity costs.

1.

Easyspread 2.0 has a higher relevant operating income than Easyspread 1.0. Based on this analysis, Easyspread 2.0 should be introduced immediately:

................................................Easyspread 1.0 ...Easyspread 2.0

Relevant revenues ....................................$150 .....................$185

Relevant costs:

...Manuals, diskettes, compact discs ..$ 0 .........................$25

.......Total relevant costs .............................__0 ......................_25

Relevant operating income ........................$150 .....................$160

Reasons for other cost items being irrelevant are:

Easyspread 1.0

· Manuals, diskettes—already incurred

· Development costs—already incurred

· Marketing and administrative—fixed costs of period

Easyspread 2.0

· Development costs—already incurred

· Marketing and administration—fixed costs of period

Note that total marketing and administration costs will not change whether Easyspread 2.0 is introduced on July 1, 2006, or on October 1, 2006.

2.

Other factors to be considered:

a. Customer satisfaction. If 2.0 is significantly better than 1.0 for its customers, a customer

driven organization would immediately introduce it unless other factors offset this bias towards “do what is best for the customer.”

b. Quality level of Easyspread 2.0. It is critical for new software products to be fully debugged. Easyspread 2.0 must be error-free. Consider an immediate release only if 2.0 passes all quality tests and can be fully supported by the salesforce.

c. Importance of being perceived to be a market leader. Being first in the market with a new product can give Basil Software a “first-mover advantage,” e.g., capturing an initial large share of the market that, in itself, causes future potential customers to lean towards purchasing Easyspread 2.0. Moreover, by introducing 2.0 earlier, Basil can get quick feedback from users about ways to further refine the software while its competitors are still working on their own first versions. Moreover, by locking in early customers, Basil may increase the likelihood of these customers also buying future upgrades of Easyspread 2.0.

d. Morale of developers. These are key people at Basil Software. Delaying introduction of a new product can hurt their morale, especially if a competitor then preempts Basil from being viewed as a market leader.

11-30 Product mix, relevant costs (N. Melumad, adapted).

1.

....................................................................R3 ................HP6

Selling price ...............................................$100 ................$150

Variable manufacturing cost per unit ................60 ..................100

Variable marketing cost per unit ...................._15 .................._35

Total variable costs per unit .........................._75 ..................135

Contribution margin per unit ........................$ 25 .................$ 15

Contribution margin per hour of the

...constrained resource (the regular machine) $25 ÷ 1 ........$15 ÷ 0.5

.................................................................= $25...............= $30

Total contribution margin from selling

.....only R3 or only HP6

R3: $25 x 50,000; HP6: $30 x 50,000 .........$1,250,000 .....$1,500,000

Less Lease costs of high-precision machine

.....to produce and sell HP6 ........................_____-___........__300,000

Net relevant benefit ..................................$1,250,000 ......$1,200,000

Even though HP6 has the higher contribution margin per unit of the constrained resource, the fact that Pendleton must incur additional costs of $300,000 to achieve this higher contribution margin means that Pendleton is better off using its entire 50,000-hour capacity on the regular machine to produce and sell 50,000 units (50,000 hours ÷ 1 hour per unit) of R3. The additional contribution from selling HP6 rather than R3 is $250,000 ($1,500,000 - $1,250,000), which is not enough to cover the additional costs of leasing the high-precision machine. Note that, because all other overhead costs are fixed and cannot be changed, they are irrelevant for the decision.

2.

If capacity of the regular machines is increased by 15,000 machine-hours to 65,000 machine-hours (50,000 originally + 15,000 new), the net relevant benefit from producing R3 and HP6 is as follows:

.........................................................................R3 ................HP6

Total contribution margin from selling only

.....R3 or only HP6

R3: $25 x 65,000; HP6: $30 x 65,000 ............$1,625,000 ....$1,950,000

Less Lease costs of high-precision machine

.....that would be incurred if HP6 is

.....produced and sold ..........................................-.................300,000

Less Cost of increasing capacity by

.....15,000 hours on regular machine .............__150,000 .......__150,000

Net relevant benefit .....................................$1,475,000 ......$1,500,000

Investing in the additional capacity increases Pendleton’s operating income by $250,000 ($1,500,000 calculated in requirement 2 minus $1,250,000 calculated in requirement 1), so Pendleton should add 15,000 hours to the regular machine. With the extra capacity available to it, Pendleton should use its entire capacity to produce HP6. Using all 65,000 hours of capacity to produce HP6 rather than to produce R3 generates additional contribution margin of $325,000 ($1,950,000 - $1,625,000) which is more than the additional cost of $300,000 to lease the high-precision machine. Pendleton should therefore produce and sell 130,000 units of HP6 (65,000 hours ÷ 0.5 hours per unit of HP6) and zero units of R3.

3.

The first step is to compare the operating profits that Pendleton could earn if it accepted the Carter Corporation offer for 20,000 units with the operating profits Pendleton is currently earning. S3 has the highest contribution margin per hour on the regular machine and requires no additional investment such as leasing a high-precision machine. To produce the 20,000 units of S3 requested by Carter Corporation, Pendleton would require 20,000 hours on the regular machine resulting in contribution margin of $35 x 20,000 = $700,000.

Pendleton now has 45,000 hours available on the regular machine to produce R3 or HP6.

........................................ ..............................R3 ...............HP6

Total contribution margin from selling

.....only R3 or only HP6

.....R3: $25 x 45,000; HP6: $30 x 45,000 .........$1,125,000 ....$1,350,000

Less Lease costs of high-precision machine

.....to produce and sell HP 6 ............................____-____ ....___300,000

Net relevant benefit .......................................$1,125,000 .....$1,050,000

Pendleton should use all the 45,000 hours of available capacity to produce 45,000 units of R3. Thus, the product mix that maximizes operating income is 20,000 units of S3, 45,000 units of R3, and zero units of HP6. This optimal mix results in a contribution margin of $1,825,000 ($700,000 from S3 and $1,125,000 from R3). Relative to requirement 2, operating income increases by $325,000 ($1,825,000 minus $1,500,000 calculated in requirement 2). Hence, Pendleton should accept the Carter Corporation business and supply 20,000 units of S3.

11-31 Dropping a product line, selling more units.

1.

The incremental revenue losses and incremental savings in cost by discontinuing the Tables product line follows:

Dropping the Tables product line results in revenue losses of $500,000 and cost savings of $370,000. Hence, Grossman Corporation’s operating income will be $130,000 higher if it does not drop the Tables line.

Note that, by dropping the Tables product line, Home Furnishings will save none of the depreciation on equipment, general administration costs, and corporate office costs, but it will save variable manufacturing costs and all marketing and distribution costs on the Tables product line.

2.

Grossman’s will generate incremental operating income of $128,000 from selling 4,000 additional tables and, hence, should try to increase table sales. The calculations follow:

.JPG)

*Note that the additional costs of equipment are relevant future costs for the "selling more tables decision" because they represent incremental future costs that differ between the alternatives of selling and not selling additional tables.

2.

Grossman’s will generate incremental operating income of $128,000 from selling 4,000 additional tables and, hence, should try to increase table sales. The calculations follow:

.JPG)

*Note that the additional costs of equipment are relevant future costs for the "selling more tables decision" because they represent incremental future costs that differ between the alternatives of selling and not selling additional tables.

@Current marketing and distribution costs which varies with number of shipments = $70,000 – $40,000 = $30,000. As the sales of tables double, the number of shipments will double, resulting in incremental marketing and distribution costs of (2 x $30,000) – $30,000 = $30,000.

**General administration and corporate office costs will be unaffected if Grossman decides to sell more tables. Hence, these costs are irrelevant for the decision.

3.

Solution Exhibit 11-31, Column 1, presents the relevant loss of revenues and the relevant savings in costs from closing the Northern Division. As the calculations show, Grossman’s operating income would decrease by $140,000 if it shut down the Northern Division (loss in revenues of $1,500,000 versus savings in costs of $1,360,000).

3.

Solution Exhibit 11-31, Column 1, presents the relevant loss of revenues and the relevant savings in costs from closing the Northern Division. As the calculations show, Grossman’s operating income would decrease by $140,000 if it shut down the Northern Division (loss in revenues of $1,500,000 versus savings in costs of $1,360,000).

Grossman will save variable manufacturing costs, marketing and distribution costs, and division general administration costs by closing the Northern Division but equipment-related depreciation and corporate office allocations are irrelevant to the decision. Equipment-related costs are irrelevant because they are past costs (and the equipment has zero disposal price). Corporate office costs are irrelevant because Grossman will not save any actual corporate office costs by closing the Northern Division. The corporate office costs that used to be allocated to the Northern Division will be allocated to other divisions.

The manager at corporate headquarters responsible for making the decision is evaluated on Northern Division’s operating income after allocating corporate office costs. The manager will evaluate the options as follows: If the manager does not close the Northern Division in 2002, the division is expected to show an operating loss of $110,000 after allocating all corporate office costs. If the manager closes the Northern Division, the division would show an operating loss of $100,000 from the write off of equipment. It would show no revenues and, hence, would not attract any corporate office costs. It would also not incur any manufacturing, marketing and distribution, and general administration costs.

From the viewpoint of maximizing the operating income against which the manager is evaluated, the manager would prefer to shut down Northern Division (and show an operating loss of $100,000 instead of an operating loss of $110,000 by operating it). In fact, the manager might argue that even the $100,000 operating loss is more a consequence of accounting write offs rather than a “real” operating loss.

Recall from the decision model favored keeping the Northern Division open. The performance evaluation model of the manager making the decision suggests that the Northern Division be closed. Hence, the performance evaluation model is inconsistent with the decision model.

4.

Solution Exhibit 11-31, Column 2, presents the relevant revenues and relevant costs of opening the Southern Division (a division whose revenues and costs are expected to be identical to the revenues and costs of the Northern Division). Grossman should open the Southern Division because it would increase operating income by $40,000 (increase in relevant revenues of $1,500,000 and increase in relevant costs of $1,460,000). The relevant costs include direct materials, direct manufacturing labor, marketing and distribution, equipment, and division general administration costs but not corporate office costs. Note, in particular, that the cost of equipment written off as depreciation is relevant because it is an expected future cost that Grossman will incur only if it opens the Southern Division. Corporate office costs are irrelevant because actual corporate office costs will not change if Grossman opens the Southern Division. The current corporate staff will be able to oversee the Southern Division’s operations. Grossman will allocate some corporate office costs to the Southern Division but this allocation represents corporate office costs that are already currently being allocated to some other division. Because actual total corporate office costs do not change, they are irrelevant to the division.

SOLUTION EXHIBIT 11-31

Relevant-Revenue and Relevant-Cost Analysis for Closing Northern Division and Opening Southern Division

.JPG)

11-32 Make or buy, unknown level of volume (A. Atkinson).4.

Solution Exhibit 11-31, Column 2, presents the relevant revenues and relevant costs of opening the Southern Division (a division whose revenues and costs are expected to be identical to the revenues and costs of the Northern Division). Grossman should open the Southern Division because it would increase operating income by $40,000 (increase in relevant revenues of $1,500,000 and increase in relevant costs of $1,460,000). The relevant costs include direct materials, direct manufacturing labor, marketing and distribution, equipment, and division general administration costs but not corporate office costs. Note, in particular, that the cost of equipment written off as depreciation is relevant because it is an expected future cost that Grossman will incur only if it opens the Southern Division. Corporate office costs are irrelevant because actual corporate office costs will not change if Grossman opens the Southern Division. The current corporate staff will be able to oversee the Southern Division’s operations. Grossman will allocate some corporate office costs to the Southern Division but this allocation represents corporate office costs that are already currently being allocated to some other division. Because actual total corporate office costs do not change, they are irrelevant to the division.

SOLUTION EXHIBIT 11-31

Relevant-Revenue and Relevant-Cost Analysis for Closing Northern Division and Opening Southern Division

.JPG)

1.

Let X = 1 starter assembly. The variable costs required to manufacture 150,000X are:

The variable costs per unit are $450,000 ÷ 150,000 = $3.00 per unit.

The data can be presented in both “all data" and "relevant data" formats:

.JPG)

The number of units at which the costs of make and buy are equivalent is:

All data analysis: ...............$340,000 + $3X = $200,000 + $4X

.............................................................X = 140,000

or

Relevant data analysis: ......$190,000 + $3X = $50,000 + $4X

..................................................... ........X = 140,000

Assuming cost minimization is the objective, then:

• If production is expected to be less than 140,000 units, it is preferable to buy units from Tidnish.

• If production is expected to exceed 140,000 units, it is preferable to manufacture internally (make) the units.

• If production is expected to be 140,000 units, this is the indifference point between buying units from Tidnish and internally manufacturing (making) the units.

2.

The information on the storage cost, which is avoidable if self-manufacture is discontinued, is relevant; these storage charges represent current outlays that are avoidable if self-manufacture is discontinued. Assume these $50,000 charges are represented as an opportunity cost of the make alternative. The costs of internal manufacture that incorporate this $50,000 opportunity cost are:

All data analysis: .....................$390,000 + $3X

Relevant data analysis: ............$240,000 + $3X

The number of units at which the costs of make and buy are equivalent is:

All data analysis: .....................$390,000 + $3X = $200,000 + $4X

.................................................................X = 190,000

Relevant data analysis: ............$240,000 + $3X = $50,000 + $4X

....................................................................X = 190,000

If production is expected to be less than 190,000, it is preferable to buy units from Tidnish. If production is expected to exceed 190,000, it is preferable to manufacture the units internally.

11-33 Make versus buy, activity-based costing, opportunity costs

1.

The allocated fixed plant administration, taxes, and insurance will not change if Ace makes or buys the chains. Hence, these costs are irrelevant to the make-or-buy decision. The analysis indicates that Ace should not buy the chains from the outside supplier.

2.

.JPG)

Ace should now buy the chains from an outside vendor and use its own capacity to upgrade its own bicycles.

3.

In this requirement, the decision on mud flaps and reflectors is irrelevant to the analysis.

Cost of manufacturing chains:

.JPG)

a$2,000 x 10 batches

In this case, Ace should buy the chains from the outside vendor.

11-34 Multiple choice; comprehensive problem on relevant costs.

You may wish to assign only some of the parts.

1. (b) $3.50

Manufacturing Costs

Variable ..........$3.00

Fixed ...............0.50

Total ...............$3.50

2. (e) None of the above. Decrease in operating income is $16,800.

.JPG)

3. (c) $3,500

If this order were not landed, fixed manufacturing overhead would be underallocated by $2,500, $0.50 per unit x 5,000 units. Therefore, taking the order increases operating income by $1,000 plus $2,500, or $3,500.

Another way to present the same idea follows:

Revenues will increase by (5,000 x $3.50 = $17,500) + $1,000.....$18,500

Costs will increase by 5,000 x $3.00 ............................................15,000

Fixed overhead will not change ........................................................–

Change in operating income ......................................................$ 3,500

Note that this answer to (3) assumes that variable marketing costs are not influenced by this contract. These 5,000 units do not displace any regular sales.

4. (a) $4,000 less ($7,500 – $3,500)

.JPG)

5. (b) $4.15

Differential costs:

.JPG)

Selling price to break even is $4.15 per unit.

6. (e) $1.50, the variable marketing costs. The other costs are past costs, and are, therefore, irrelevant.

7. (e) None of these. The correct answer is $3.55. This part always gives students trouble. The short-cut solution below is followed by a longer solution that is helpful to students.

Short-cut solution:

The highest price to be paid would be measured by those costs that could be avoided by halting production and subcontracting:

.JPG)

Longer but clearer solution:

.JPG)

*This solution is obtained by filling in the above schedule with all the known figures and working "from the bottom up" and "from the top down" to the unknown purchase figure. Maximum variable costs that can be incurred, $1,140,000 – $288,000 = maximum purchase costs, or $852,000. Divide $852,000 by 240,000 units, which yields a maximum purchase price of $3.55.

11-35 Make or buy (continuation of 11-34).

The maximum price Class Company should be willing to pay is $3.9417 per unit.

Expected unit production and sales of new product must be half of the old product (1/2 x 240,000 = 120,000) because the fixed manufacturing overhead rate for the new product is twice that of the fixed manufacturing overhead rate for the old product.

*This is an example of opportunity costs, whereby subcontracting at a price well above the $3.50 current manufacturing (absorption) cost is still desirable because the old product will be displaced in manufacturing by a new product that is more profitable.

Because the new product promises an operating income of $60,000 (ignoring the irrelevant problems of how fixed marketing costs may be newly reallocated between products), the old product can sustain up to a $10,000 loss and still help accomplish management's overall objectives. Maximum costs that can be incurred on the old product are $1,440,000 plus the $10,000 loss, or $1,450,000. Maximum purchase cost: $1,450,000 – ($288,000 + $216,000) = $946,000. Maximum purchase cost per unit: $946,000 ÷ 240,000 units = $3.9417 per unit.

Alternative Computation

.JPG)

11-37 Optimal product mix.

1.

Let D represent the batches of Della’s Delight made and sold.

Let B represent the batches of Bonny’s Bourbon made and sold.

The contribution margin per batch for Della’s Delight is $525 - $175 = $350.

The contribution margin per batch for Bonny’s Bourbon is $335 - $85 = $250.

The LP formulation for the decision is:

Maximize ......$350D + $250 C

Subject to ........30D + 15C ≤ 600 (Mixing Department constraint)

........................10D + 15C ≤ 300 (Baking Department constraint)

........................20D ≤ 320 (Dipping Department constraint)

2.

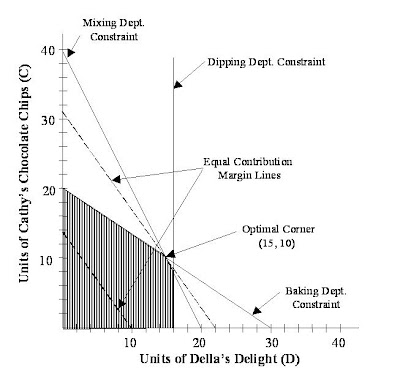

Solution Exhibit 11-37 presents a graphical summary of the relationships. The optimal corner is the point (15,10), 15 Della’s Delights and 10 Bonny’s Bourbon.

SOLUTION EXHIBIT 11-37

Graphic Solution to Find Optimal Mix, Della Simpson, Inc.

We next calculate the optimal production mix using the trial-and-error method.

The corner point where the Mixing Dept. and Baking Dept. constraints meet can be calculated by solving:

......30D + 15C = 600 (1) Mixing Dept. constraint

......10D + 15C = 300 (2) Baking Dept. constraint

Substracting (2) from (1), we have

......20D = 300

or ......D = 15

Substituting in (2)

..................10 x 15 + 15C = 300

that is, ......................15C = 300 - 150 = 150

or ......................... ......C = 10

The corner point where the Mixing Dept. and Dipping Dept. constraints meet can be calculated by solving

......30D + 15C = 600 (1) Mixing Dept. constraint

................20D = 320 (3) Dipping Dept. constraint

From equation (3), D = 320 ÷ 20 = 16

Substituting in (1),

........(30 x 16) + 15C = 600

................ .......15C = 600 - 480 = 120

................ ...........C = 8

We next use the trial-and-error method to check the contribution margins at each of the five corner points of the area of feasible solutions.

.JPG)

The optimal solution that maximizes operating income is 15 Della’s Delights and 10 Bonny’s Bourbon.

11-38 Make versus buy, ethics (CMA, adapted).

1.

An analysis of relevant costs that shows whether Paibec Corporation should make MTR-

2000 or purchase it from Marley Company for 2002 follows:

2.

Based solely on the financial results, the 32,000 units of MTR-2000 for 2002 should be purchased from Marley. The total cost from Marley would be $559,600, or $15,440 less than if the units were made by Paibec.

At least three other factors that Paibec Corporation should consider before agreeing to purchase MTR-2000 from Marley Company include the following:

· The quality of the Marley component should be equal to, or better than, the quality of the internally made component. Otherwise, the quality of the final product might be compromised and Paibec’s reputation affected.

· Marley’s reliability as an on-time supplier is important, since late deliveries could hamper Paibec’s production schedule and delivery dates for the final product.

· Layoffs may result if the component is outsourced to Marley. This could impact Paibec’s other employees and cause labor problems or affect the company’s position in the community. In addition, there may be termination costs, which have not been factored into the analysis.

4.

Referring to “Standards of Ethical Conduct for Management Accountants,” in Exhibit 1-7 Lynn Hardt would consider the request of John Porter to be unethical for the following reasons.

Competence

· Prepare complete and clear reports and recommendations after appropriate analysis of relevant and reliable information. Adjusting cost numbers violates the competence standard.

Integrity

· Refrain from either actively or passively subverting the attainment of the organization’s legitimate and ethical objectives. Paibec has a legitimate objective of trying to obtain the component at the lowest cost possible, regardless of whether it is manufactured internally or outsourced to Marley.

· Communicate unfavorable as well as favorable information and professional judgments or opinions. Hardt needs to communicate the proper and accurate results of the analysis, regardless of whether or not it favors internal production.

· Refrain from engaging in or supporting any activity that would discredit the profession. Falsifying the analysis would discredit Hardt and the profession.

Objectivity

· Communicate information fairly and objectively. Hardt needs to perform an objective make-versus-buy analysis and communicate the results fairly.

· Disclose fully all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, comments, and recommendations presented. Hardt needs to fully disclose the analysis and the expected cost increases.

Confidentiality

· Not affected by this decision.

Hardt should indicate to Porter that the costs derived under the make alternative are correct. If Porter still insists on making the changes to lower the costs of making MTR-2000 internally, Hardt should raise the matter with Porter’s superior, after informing Porter of her plans. If, after taking all these steps, there is a continued pressure to understate the costs, Hardt should consider resigning from the company, rather than engage in unethical conduct.

11-39 Optimal product mix (CMA, adapted).

In order to maximize OmniSport Inc.’s profitability, OmniSport should manufacture 12,000 snowboard bindings, manufacture 1,000 pairs of skates, and purchase 6,000 pairs of skates from Colcott Inc. This combination of manufactured and purchased goods maximizes the contribution margin per available machine-hour, which is the limiting resource.