4.27

a) Factors that affect the reliability of confirmations:

- The form of the confirmation

- Prior experience with the entity

- The nature of the information being confirmed

- The intended respondent

b) Information on DynaStyle's financial statements that might be verified through the use of information:

- Cash & bank balances - confirm the amount balance from the bank.

4.29

a) Purposes of analytical procedures:

- Preliminary analytical procedures - used to assist the auditor to better understand the business & to design the nature, timing, & extend of audit procedures.

- Substantive analytical procedures - used as a substantive procedure to obtain audit evidence about particular assertions related to account balances @ classes of transactions.

- Final analytical procedures - used as an overall review of the financial information in the final review stage of the audit.

b) Source of information:

- Financial & operating data

- Budgets & forecasts

- Industry publication

- Competitor information

- Management's analysis

- Analyst's report

c) The factors that influence an auditor's consideration of the reliability of data:

- The independence of the source of the evidence

- The effectiveness of internal controls

- The auditor's direct personal knowledge

5.13

2 major types of working paper files:

- Permanent files - historical data about the client that are of continuing relevance to the audit.

- Current files - include information & data related specifically to the current year's engagement.

Examples:

Permanent file

- Chart of account

- Copies of important contract

Current file

- Audit plan & audit program

- Adjusting & reclassification journal entries

5.14

Indexing & cross-referencing important to the documentation of audit working papers because the members of the audit team @ firm can find the relevant audit evidence & it can be linked in audit software. This process of indexing & cross-referencing provides a trail from the financial statements to the individual audit documents that a reviewer can easily follow.

5.36

a) Purposes of working papers:

- to record of audit procedures performed, to obtain the relevant audit evidence, & the conclusions reached by the auditor in the engagement.

b) The various types of audit documents:

- Audit memoranda

- Account analysis & listings

- Working trial balance

c)

Extra questions

Sunday, July 27, 2008

Wednesday, July 23, 2008

Tutorial 3

Tutorial 2

Review Questions

1.

Excess demand occurs when price falls below the equilibrium price. In this situation, consumer are demanding a higher quantity than is being made available by suppliers. This creates pressure for the price to increase. As the price increases, quantity demanded will fall as quantity supplied increases returning market to equilibrium.

Excess supply occurs when price is above the equilibrium price. Suppliers have made available more units than consumers are willing to purchase at the higher price. This creates pressure for the price to decrease. As the price decreases, quantity demanded will go up while at the same time the quantity supplied will decrease, returning the market to equilibrium.

4.

When (-), it is an inelastic.

5.

Demand curve

Q = 50 - 100P

Chock price, where Q = 0

...Q = 50 - 100P

...0 = 50 - 100P

...100P = 50

...P = RM 0.50

6.

Speed boats could probably be categorized as a luxury item whereas light bulbs are more likely categorized as a necessity. For the necessity, the change in quantity demanded will be relatively small for any percentage change in price. The change in quantity demanded may be quit large, however, for a luxury item. Since the percentage change in quantity demanded is likely higher for the luxury item for any given percentage change in price, the elasticity of demand will be less (more negative).

Current situation in Malaysia:

FUEL - necessity good because fuel can't be substitute.

HOUSING LOAN - luxury good because can be substitute (can apply loan for 'rumah cost rendah' instead of loan for bungalow).

Problem questions

2.1

a)

b)

c)

2.2

a)

b)

2.3

a)

b)

1.

Excess demand occurs when price falls below the equilibrium price. In this situation, consumer are demanding a higher quantity than is being made available by suppliers. This creates pressure for the price to increase. As the price increases, quantity demanded will fall as quantity supplied increases returning market to equilibrium.

Excess supply occurs when price is above the equilibrium price. Suppliers have made available more units than consumers are willing to purchase at the higher price. This creates pressure for the price to decrease. As the price decreases, quantity demanded will go up while at the same time the quantity supplied will decrease, returning the market to equilibrium.

4.

When (-), it is an inelastic.

5.

Demand curve

Q = 50 - 100P

Chock price, where Q = 0

...Q = 50 - 100P

...0 = 50 - 100P

...100P = 50

...P = RM 0.50

6.

Speed boats could probably be categorized as a luxury item whereas light bulbs are more likely categorized as a necessity. For the necessity, the change in quantity demanded will be relatively small for any percentage change in price. The change in quantity demanded may be quit large, however, for a luxury item. Since the percentage change in quantity demanded is likely higher for the luxury item for any given percentage change in price, the elasticity of demand will be less (more negative).

Current situation in Malaysia:

FUEL - necessity good because fuel can't be substitute.

HOUSING LOAN - luxury good because can be substitute (can apply loan for 'rumah cost rendah' instead of loan for bungalow).

Problem questions

2.1

a)

b)

c)

2.2

a)

b)

2.3

a)

b)

Friday, July 18, 2008

Lesson 1

I will tell you how to finish every lesson within 30 minutes.

Firstly, you should use the CAPS LOCK when you key in the data.

Secondly, you should use the keyboard function for UBS rather than use mouse to make you work faster than other people.

1 - Use TAB if you want to go to the next box.

2 - Use ALT + O if you what to click ok.

3 - Use ALT + V if you want to save.

4 - Use ENTER if you want to accept or choose the correct item.

5 - Use

Thirdly, you need to remember this; go to HOUSEKEEPING to make up the Run Setup every time you start the new company, in other word to start your Lesson. You should do this thing before you start key in the data. If you don't do it, you will get the problem later on.

Go to General Setting under Run Setup, then filling the company's name & address. Then you need to make sure the last year accounting period is correct. In this Lesson, Sunny started the business on 1st of January 2005. So, the last year accounting period is 31/12/04. The period of this company is 12 months. So, the starting period is 1 & the closing period is 12.

Fourthly, you can key in the data as required in your exercise book.

1) You need to key in the item given from Chart of Account. You go to GENERAL, then select General Ledger A/C Maintenance. Then key in the accounts give.

2) You go to TRANSACTION, then select Organise Batches. Then, key in the batches given.

3) You go to TRANSACTION, then select Transaction File Maintenance

Finally,

Note:

Actually the UBS text book (pink color, thick one) have show you the step you should do. But, here i will elaborate it clearly to make you understand better. And if you have some problem regarding to this exercise, you may ask me in my blog. Thank you.

Firstly, you should use the CAPS LOCK when you key in the data.

Secondly, you should use the keyboard function for UBS rather than use mouse to make you work faster than other people.

1 - Use TAB if you want to go to the next box.

2 - Use ALT + O if you what to click ok.

3 - Use ALT + V if you want to save.

4 - Use ENTER if you want to accept or choose the correct item.

5 - Use

Thirdly, you need to remember this; go to HOUSEKEEPING to make up the Run Setup every time you start the new company, in other word to start your Lesson. You should do this thing before you start key in the data. If you don't do it, you will get the problem later on.

Go to General Setting under Run Setup, then filling the company's name & address. Then you need to make sure the last year accounting period is correct. In this Lesson, Sunny started the business on 1st of January 2005. So, the last year accounting period is 31/12/04. The period of this company is 12 months. So, the starting period is 1 & the closing period is 12.

Fourthly, you can key in the data as required in your exercise book.

1) You need to key in the item given from Chart of Account. You go to GENERAL, then select General Ledger A/C Maintenance. Then key in the accounts give.

2) You go to TRANSACTION, then select Organise Batches. Then, key in the batches given.

3) You go to TRANSACTION, then select Transaction File Maintenance

Finally,

Note:

Actually the UBS text book (pink color, thick one) have show you the step you should do. But, here i will elaborate it clearly to make you understand better. And if you have some problem regarding to this exercise, you may ask me in my blog. Thank you.

Tutorial 2

17.1

Basis period for:

Food catering business

1/4//04 - 31/12/04 (YA 04)

1/7/04 - 30/6/05 (YA 05)

1/7/05 - 30/6/06 (YA 06)

1/7/06 - 30/6/07 (YA 07)

Retailing business

1/1/06 - 31/12/06 (YA 06)

1/7/06 - 30/6/07 (YA 07)

b)

17.2

Basis period

1/7/04 - 31/12/04 (YA 04)

1/1/05 - 31/12/05 (YA 05)

1/3/05 - 28/2/06 (YA 06)

1/3/28 - 28/2/07 (YA 07)

* Capital Allowance

YA 05, 06 & 07 - A.A (20% x 48,000)

.....................= 9,600

17.3

Basis period

1/2/05 - 31/1/06 (YA 06)

1/2/06 - 30/6/07 (YA 07)

17.4

a)

Basis period

1/1/03 - 31/12/03 (YA 03)

1/1/04 - 31/12/04 (YA 04)

1/7/04 - 30/6/05 (YA05)

1/7/05 - 30/4/06 (YA 06) FY

1/5/06 - 30/4/07 (YA 07)

b)

Failure year - YA 06

Failure year is happen when any accounts which is prepared > 12 months @ <>

17.5

a)

1/1/05 - 31/12/05 (YA 05)

1/1/06 -31/12/06 (YA 06)

1/4/06 -31/3/07 (YA 07)

b) Overlapping period = 1/4/06 - 31/12/06

c)

Basis year - calendar year basis @ accounting period.

Basis period - date in the YA

17.6

1/7/07 - 30/11/07 (YA 07)

The first basis period for a new business commenced by Nova Sdn Bhd is until 30/11/07. The reason is the new business need to follow the ultimate/parent/holding company's financial year.

17.7

1.

1/10/07 - 31/3/08 & thereafter to 31/3

Basis period

1/10/07 - 31/12/07 (YA 07)

1/1/08 - 31/12/08 (YA 08)

1/4/08 - 31/3/09 (YA 09)

The change in accounting period is non 31/12 & less than 12 months, therefore the basis period is end 31/12 until account are made up for a 12 months accounting period.

2.

1/10/07 - 31/3/09 & thereafter to 31/3

Basis period

1/10/06 - 31/12/07 (YA 07)

1/1/08 - 31/12/08 (YA 08) FY

1/1/09 - 31/12/09 (YA 09) FY

1/4/09 - 31/3/10 (YA 10)

The change in accounting period is non 31/12 and more than 12 months, therefore the basis period is end 31/12 until account are made up for a 12 months accounting period.

3.

1/10/07 - 30/9/08 & thereafter to 30/9

Basis period

1/10/07 - 30/9/08 (YA 08)

1/10/08 - 30/9/09 (YA 09)

The accounting year is 12 months and there is no change in accounting date. There is no change for basis period.

Basis period for:

Food catering business

1/4//04 - 31/12/04 (YA 04)

1/7/04 - 30/6/05 (YA 05)

1/7/05 - 30/6/06 (YA 06)

1/7/06 - 30/6/07 (YA 07)

Retailing business

1/1/06 - 31/12/06 (YA 06)

1/7/06 - 30/6/07 (YA 07)

b)

17.2

Basis period

1/7/04 - 31/12/04 (YA 04)

1/1/05 - 31/12/05 (YA 05)

1/3/05 - 28/2/06 (YA 06)

1/3/28 - 28/2/07 (YA 07)

* Capital Allowance

YA 05, 06 & 07 - A.A (20% x 48,000)

.....................= 9,600

17.3

Basis period

1/2/05 - 31/1/06 (YA 06)

1/2/06 - 30/6/07 (YA 07)

17.4

a)

Basis period

1/1/03 - 31/12/03 (YA 03)

1/1/04 - 31/12/04 (YA 04)

1/7/04 - 30/6/05 (YA05)

1/7/05 - 30/4/06 (YA 06) FY

1/5/06 - 30/4/07 (YA 07)

b)

Failure year - YA 06

Failure year is happen when any accounts which is prepared > 12 months @ <>

17.5

a)

1/1/05 - 31/12/05 (YA 05)

1/1/06 -31/12/06 (YA 06)

1/4/06 -31/3/07 (YA 07)

b) Overlapping period = 1/4/06 - 31/12/06

c)

Basis year - calendar year basis @ accounting period.

Basis period - date in the YA

17.6

1/7/07 - 30/11/07 (YA 07)

The first basis period for a new business commenced by Nova Sdn Bhd is until 30/11/07. The reason is the new business need to follow the ultimate/parent/holding company's financial year.

17.7

1.

1/10/07 - 31/3/08 & thereafter to 31/3

Basis period

1/10/07 - 31/12/07 (YA 07)

1/1/08 - 31/12/08 (YA 08)

1/4/08 - 31/3/09 (YA 09)

The change in accounting period is non 31/12 & less than 12 months, therefore the basis period is end 31/12 until account are made up for a 12 months accounting period.

2.

1/10/07 - 31/3/09 & thereafter to 31/3

Basis period

1/10/06 - 31/12/07 (YA 07)

1/1/08 - 31/12/08 (YA 08) FY

1/1/09 - 31/12/09 (YA 09) FY

1/4/09 - 31/3/10 (YA 10)

The change in accounting period is non 31/12 and more than 12 months, therefore the basis period is end 31/12 until account are made up for a 12 months accounting period.

3.

1/10/07 - 30/9/08 & thereafter to 30/9

Basis period

1/10/07 - 30/9/08 (YA 08)

1/10/08 - 30/9/09 (YA 09)

The accounting year is 12 months and there is no change in accounting date. There is no change for basis period.

Tutorial 2

2.39

a) Area of operational auditor - at the warehouse where the plant is placed.

b) Sources of criteria @ types of standard are International Standard of Auditing (ISA) & Malaysian Standard of Auditing (MSA).

4.1

Assertions are expresses @ implied representations by management that are reflected in the financial statement components. The 3 components are:

- Transactions & events for the period under audit

- Account balances at the period end

- Presentation & disclosure

Auditor divides the financial statement into components @ segments in order to test management's assertions to ensure that assertion are made to every components:

- Transactions - occurrence, completeness, accuracy, cutoff & classification.

- Account balance - Existence, rights & obligations, completeness, & valuation and allocation.

- Presentation & disclosure - occurrence & rights and obligations, completeness, classification & understandability, & accuracy and valuation.

4.3

Most instances audit evidence is persuasive rather than convincing because audit evidence used by the auditor in arriving at the conclusion is based on auditor's opinion after they found the information in the accounting records underlying the financial statements. Audit evidence is not convincing because an auditor's can't find all the evidence because of time constrains, reliability, credibility & fees.

4.4

Audit procedures for obtaining audit evidence:

1 - Inspection of Records @ Documents

- Inspection consists of examining internal @ external records @ documents that are in the paper form, electronic form, @ other media.

2- Examination of Physical Assets

- This procedure involves the auditor inspecting @ counting of physical asset. Physical examination of tangible assets provides a relatively reliable type of evidence.

3- Observation

- Observation consists of looking at a process @ procedure being performed by others. The actions being observed typically do not leave an audit trail that can be verified by examining records @ documents.

4 - Inquiry

- Inquiry consists of seeking information of knowledgeable persons (both financial & non-financial throughout the entity @ outside the entity. Inquiry is an important audit procedure that is used extensively throughout the audit & often is complementary to performing other audit procedures.

5 - Confirmation

- Confirmation is a specific type of inquiry. It is the process of obtaining a representation of information @ of an existing condition directly from a third party. Confirmations also are used to obtain audit evidence about the absence of certain conditions.

6 - Scanning

- Scanning is the review of accounting data to identify significant @ unusual items. This includes the identification of anomalous individual items within account balances @ other client data through the scanning @ analysis of entries in transaction listings, subsidiary ledgers, general ledger control accounts, adjusting entries, suspense accounts, reconciliations, & other detailed reports.

7 - Computation

- Computation @ recalculation consists of checking the mathematical accuracy of documents @ records. Computation can be performed through the use of information technology.

8 - Re-performance

- Re-performance is the auditor's independent execution of procedures @ controls that were originally performed as part of the entity's internal control, either manually @ through the use of computer-assisted audit techniques (CAATs).

9 - Analytical Procedure

- Analytical procedures are important type of procedures on an audit. They consist of evaluations of financial information made by a study of comparisons & relationships among both financial & non-financial data.

4.5

4.7

4.8

3 general types of audit test are:

1- Risk assessment procedures

- To obtain an understanding of the entity & its environment in order to assess the risks of material misstatement at the financial statement & assertion level that .

- E.g. - Inspection of Records @ Documents

- Inquiry

2- Tests of controls

- To test the operating effectiveness of controls in preventing, @ detecting & correcting, material misstatements at the assertion level based on the auditor's understanding of the entity's internal control.

- E.g. - Re-performance

- Observation

3 - Substantive procedures

- To detect material misstatement at the assertion level based on the assessed risk of material misstatement.

- E.g. -

-

4.23

4.25

4.32

a) Area of operational auditor - at the warehouse where the plant is placed.

b) Sources of criteria @ types of standard are International Standard of Auditing (ISA) & Malaysian Standard of Auditing (MSA).

4.1

Assertions are expresses @ implied representations by management that are reflected in the financial statement components. The 3 components are:

- Transactions & events for the period under audit

- Account balances at the period end

- Presentation & disclosure

Auditor divides the financial statement into components @ segments in order to test management's assertions to ensure that assertion are made to every components:

- Transactions - occurrence, completeness, accuracy, cutoff & classification.

- Account balance - Existence, rights & obligations, completeness, & valuation and allocation.

- Presentation & disclosure - occurrence & rights and obligations, completeness, classification & understandability, & accuracy and valuation.

4.3

Most instances audit evidence is persuasive rather than convincing because audit evidence used by the auditor in arriving at the conclusion is based on auditor's opinion after they found the information in the accounting records underlying the financial statements. Audit evidence is not convincing because an auditor's can't find all the evidence because of time constrains, reliability, credibility & fees.

4.4

Audit procedures for obtaining audit evidence:

1 - Inspection of Records @ Documents

- Inspection consists of examining internal @ external records @ documents that are in the paper form, electronic form, @ other media.

2- Examination of Physical Assets

- This procedure involves the auditor inspecting @ counting of physical asset. Physical examination of tangible assets provides a relatively reliable type of evidence.

3- Observation

- Observation consists of looking at a process @ procedure being performed by others. The actions being observed typically do not leave an audit trail that can be verified by examining records @ documents.

4 - Inquiry

- Inquiry consists of seeking information of knowledgeable persons (both financial & non-financial throughout the entity @ outside the entity. Inquiry is an important audit procedure that is used extensively throughout the audit & often is complementary to performing other audit procedures.

5 - Confirmation

- Confirmation is a specific type of inquiry. It is the process of obtaining a representation of information @ of an existing condition directly from a third party. Confirmations also are used to obtain audit evidence about the absence of certain conditions.

6 - Scanning

- Scanning is the review of accounting data to identify significant @ unusual items. This includes the identification of anomalous individual items within account balances @ other client data through the scanning @ analysis of entries in transaction listings, subsidiary ledgers, general ledger control accounts, adjusting entries, suspense accounts, reconciliations, & other detailed reports.

7 - Computation

- Computation @ recalculation consists of checking the mathematical accuracy of documents @ records. Computation can be performed through the use of information technology.

8 - Re-performance

- Re-performance is the auditor's independent execution of procedures @ controls that were originally performed as part of the entity's internal control, either manually @ through the use of computer-assisted audit techniques (CAATs).

9 - Analytical Procedure

- Analytical procedures are important type of procedures on an audit. They consist of evaluations of financial information made by a study of comparisons & relationships among both financial & non-financial data.

4.5

4.7

4.8

3 general types of audit test are:

1- Risk assessment procedures

- To obtain an understanding of the entity & its environment in order to assess the risks of material misstatement at the financial statement & assertion level that .

- E.g. - Inspection of Records @ Documents

- Inquiry

2- Tests of controls

- To test the operating effectiveness of controls in preventing, @ detecting & correcting, material misstatements at the assertion level based on the auditor's understanding of the entity's internal control.

- E.g. - Re-performance

- Observation

3 - Substantive procedures

- To detect material misstatement at the assertion level based on the assessed risk of material misstatement.

- E.g. -

-

4.23

4.25

4.32

Tutorial 1

Question from book Spiceland

BE 15.5

BE 15.6

BE 15.11

BE 15.12

Question from slide

1.

Finance lease

- A lease that transfers substantially all the risks & rewards incident to ownership from the lessor to the lessee.

Operating lease

- A lease that does not transfer substantially all the risks & rewards incident to ownership from the lessor to the lessee.

2.

Direct finance lease

-

Sales type lease

- Differs from a direct financing lease in only one respect that is for recognizing the profit at the inception of the lease.

3.

Advantages of leasing

- Overcome cash flow problem

- The net cost of leasing often is less than the cost of purchasing when the operational, tax, & financial market advantages are considered.

-

Disadvantages of leasing

-

4.

Off Balance Sheet financing

- When funds are borrowed to purchase an asset, the liability has a detrimental effect on the company's debt-equity ratio & other quantifiable indicators of riskiness.

- Sometimes Off Balance Sheet financing helps a firm avoid exceeding contractual limits on designated financial ratios (like the debt to equity ratio).

5.

Substance over Form

- Report transaction/events based on commercial/economic reality & not strictly on legal form.

- Affect the accounting treatment of lease based on risks & rewards incident to the ownership.

- There are 2 substance of the transaction, that is a rental agreement & a purchase/sale accompanied by debt financing

6.

a) Lease term

- Lease term is 75% of expected life of the asset.

b) Bargain purchase option

- A provision in the lease contract that gives the lessee the option of purchasing the leased property at a bargain price.

c) MLP from the standpoint of the lessee & lessor

- Present value (PV) of the minimum lease payment (MLP) amounts is equal to @ greater than 90% of the fair value of the asset at the inception of the lease.

d) Interest rate implicit in the lease

- The desires rate of return the lessor has in mind when deciding the size of the rental payments.

- This is the effective interest rate the lease payments provide the lessor over & above the price at which the asset is sold under the lease.

e) Initial direct cost

- The costs incurred by the lessors that are associated directly with originating a lease & are essential to acquire that lease.

f) Executory cost

- Lease agreements usually are written in such a way that the costs; maintenance insurance, taxes, & any other costs are borne by the lessee.

7.

a) At the inception of lease

-

b) During the first year of lease

-

8.

Disclosure requirement for the lessee & lessor if the lease is

i) Finance lease

-

ii) Operating lease

-

9.

The owner of an asset wants to sell an asset & then lease it back because

10.

Question from handout

1.

2.

3.

BE 15.5

BE 15.6

BE 15.11

BE 15.12

Question from slide

1.

Finance lease

- A lease that transfers substantially all the risks & rewards incident to ownership from the lessor to the lessee.

Operating lease

- A lease that does not transfer substantially all the risks & rewards incident to ownership from the lessor to the lessee.

2.

Direct finance lease

-

Sales type lease

- Differs from a direct financing lease in only one respect that is for recognizing the profit at the inception of the lease.

3.

Advantages of leasing

- Overcome cash flow problem

- The net cost of leasing often is less than the cost of purchasing when the operational, tax, & financial market advantages are considered.

-

Disadvantages of leasing

-

4.

Off Balance Sheet financing

- When funds are borrowed to purchase an asset, the liability has a detrimental effect on the company's debt-equity ratio & other quantifiable indicators of riskiness.

- Sometimes Off Balance Sheet financing helps a firm avoid exceeding contractual limits on designated financial ratios (like the debt to equity ratio).

5.

Substance over Form

- Report transaction/events based on commercial/economic reality & not strictly on legal form.

- Affect the accounting treatment of lease based on risks & rewards incident to the ownership.

- There are 2 substance of the transaction, that is a rental agreement & a purchase/sale accompanied by debt financing

6.

a) Lease term

- Lease term is 75% of expected life of the asset.

b) Bargain purchase option

- A provision in the lease contract that gives the lessee the option of purchasing the leased property at a bargain price.

c) MLP from the standpoint of the lessee & lessor

- Present value (PV) of the minimum lease payment (MLP) amounts is equal to @ greater than 90% of the fair value of the asset at the inception of the lease.

d) Interest rate implicit in the lease

- The desires rate of return the lessor has in mind when deciding the size of the rental payments.

- This is the effective interest rate the lease payments provide the lessor over & above the price at which the asset is sold under the lease.

e) Initial direct cost

- The costs incurred by the lessors that are associated directly with originating a lease & are essential to acquire that lease.

f) Executory cost

- Lease agreements usually are written in such a way that the costs; maintenance insurance, taxes, & any other costs are borne by the lessee.

7.

a) At the inception of lease

-

b) During the first year of lease

-

8.

Disclosure requirement for the lessee & lessor if the lease is

i) Finance lease

-

ii) Operating lease

-

9.

The owner of an asset wants to sell an asset & then lease it back because

10.

Question from handout

1.

2.

3.

Wednesday, July 16, 2008

Tutorial 2

Question 2.3

a) Bar chart

Pie Chart

Pareto Diagram

b) Pareto Diagram

- Better way to portray data.

- Show a descending order.

- Show 2 information in 1 graph.

- Cumulative polygon is draw in same scale.

c) Little @ no knowledge of company

Question 2.8

a) Bar Chart

Pie Chart

b) Bar Chart

Question 2.17

a) Ordered Array

....0 0 5 5 5 5 5 5 6 6 6 7 7 7 8 8 9 9 9 10 10 10 10 10 12 12

b) Stem-and-leaf

....0...0 0 5 5 5 5 5 5 6 6 6 7 7 7 8 8 9 9 9

....1...0 0 0 0 0 2 2

c) Stem-and-leaf

d) Concentrated at range 5 to 10.

Question 2.25

a)

b) Histogram

Percentage polygon

c) Cumulative percentage polygon

d) The strength of the insulators must be at least 1,500 pound

....to meet company's requirement.

Question 2.31

a) Total Percentage

(better rounding the percentage)

Row Percentage

(better rounding the percentage)

Row percentage show the different between tests in the day & evening by nonconforming and conforming.

Column Percentage

(better rounding the percentage)

Column percentage show the different between nonconforming & conforming tests in the day & evening.

b) Row percentage

c) Nonconforming laboratory tests is very different in the day & evening. Therefore director can cut the number of nonconforming laboratory test in the evening that run improperly to reduce the cost.

Question 2.38

a)

b) No relationship.

c) The higher-priced refrigerators not necessarily have the greatest

....efficiency. Yes, it is borne out by the data.

Question 2.68

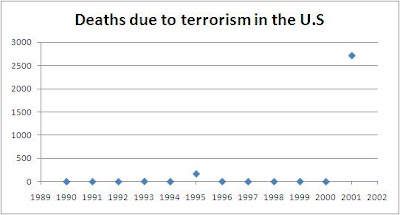

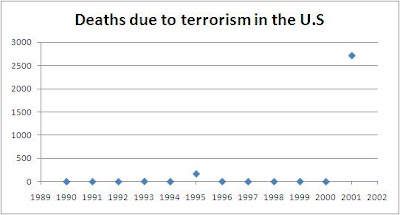

a)

From the graph, deaths due to terrorism in the U.S from 1990 until year 2000 is almost flat, and suddenly increase in the year 2001.

b) Bar Chart

Pie Chart

Pareto Diagram

c) Pie Chart

d) Most of the deaths in U.S is caused by heart diseases, followed by

....cancer & strokes and related diseases. These diseases may be caused

....from the lifestyle of the U.S citizens; the way they eat (fast food) that is

....not good for their health.

Question 2.81

a) Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

b) Histogram

Average travel-to-work times in minute

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

Percentage polygon

Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

c) Cumulative percentage distribution

Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

Cumulative percentage polygon

Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

a) Bar chart

Pie Chart

Pareto Diagram

b) Pareto Diagram

- Better way to portray data.

- Show a descending order.

- Show 2 information in 1 graph.

- Cumulative polygon is draw in same scale.

c) Little @ no knowledge of company

Question 2.8

a) Bar Chart

Pie Chart

b) Bar Chart

Question 2.17

a) Ordered Array

....0 0 5 5 5 5 5 5 6 6 6 7 7 7 8 8 9 9 9 10 10 10 10 10 12 12

b) Stem-and-leaf

....0...0 0 5 5 5 5 5 5 6 6 6 7 7 7 8 8 9 9 9

....1...0 0 0 0 0 2 2

c) Stem-and-leaf

d) Concentrated at range 5 to 10.

Question 2.25

a)

b) Histogram

Percentage polygon

c) Cumulative percentage polygon

d) The strength of the insulators must be at least 1,500 pound

....to meet company's requirement.

Question 2.31

a) Total Percentage

(better rounding the percentage)

Row Percentage

(better rounding the percentage)

Row percentage show the different between tests in the day & evening by nonconforming and conforming.

Column Percentage

(better rounding the percentage)

Column percentage show the different between nonconforming & conforming tests in the day & evening.

b) Row percentage

c) Nonconforming laboratory tests is very different in the day & evening. Therefore director can cut the number of nonconforming laboratory test in the evening that run improperly to reduce the cost.

Question 2.38

a)

b) No relationship.

c) The higher-priced refrigerators not necessarily have the greatest

....efficiency. Yes, it is borne out by the data.

Question 2.68

a)

From the graph, deaths due to terrorism in the U.S from 1990 until year 2000 is almost flat, and suddenly increase in the year 2001.

b) Bar Chart

Pie Chart

Pareto Diagram

c) Pie Chart

d) Most of the deaths in U.S is caused by heart diseases, followed by

....cancer & strokes and related diseases. These diseases may be caused

....from the lifestyle of the U.S citizens; the way they eat (fast food) that is

....not good for their health.

Question 2.81

a) Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

b) Histogram

Average travel-to-work times in minute

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

Percentage polygon

Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

c) Cumulative percentage distribution

Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

Cumulative percentage polygon

Average travel-to-work times in minutes

Percentage of homes with 8 @ more rooms

Median household income

Percentage of mortgage-paying more than 30% of income

Subscribe to:

Posts (Atom)